Federal Reserve Proposes Expanding Main Street Lending Program to Nonprofit Organizations

By Robert Berdanier, CPA, David Duski, CPA, Paul Peterson, CPA, and Joyce Underwood, CPA

On June 15, the Federal Reserve announced a proposed expansion to its Main Street Lending Program (MSLP) to address the liquidity needs of nonprofit organizations that have been impacted by the COVID-19 pandemic. The MSLP was established by the Federal Reserve earlier this year when the Treasury Department carved out $75 billion of the available $454 billion under Title IV of the Coronavirus Aid, Relief, and Economic Security (CARES) Act to make an equity investment in a special purpose vehicle (SPV), which enabled the flow of credit to small and medium-sized businesses that were in good financial standing prior to the COVID-19 crisis.

Previously, nonprofit organizations were not eligible to participate in the program given their absence of EBITDA, a key underwriting metric required for the three existing MSLP facilities. However, the Federal Reserve then evaluated the feasibility of adjusting the borrower eligibility criteria and loan eligibility metrics of the program for nonprofit organizations.

Under the proposed expansion, tax-exempt organizations under section 501(c)(3) or 501(c)(19) of the Internal Revenue Code would be eligible to apply. It’s also important to note that organizations that have received loans under the Paycheck Protection Program (PPP) could also apply for a loan under the MSLP provided they are otherwise eligible. The Federal Reserve sought public feedback on the proposed expansion via email through June 22.

According to Federal Reserve Chair Jerome Powell, “nonprofit organizations are critical parts of our economy, employing millions of people, providing essential services to communities, and supporting innovation and the development of a highly skilled workforce. Nonprofits provide vital services across the country and we are working to help them through this difficult time.”

Proposed Loan Terms

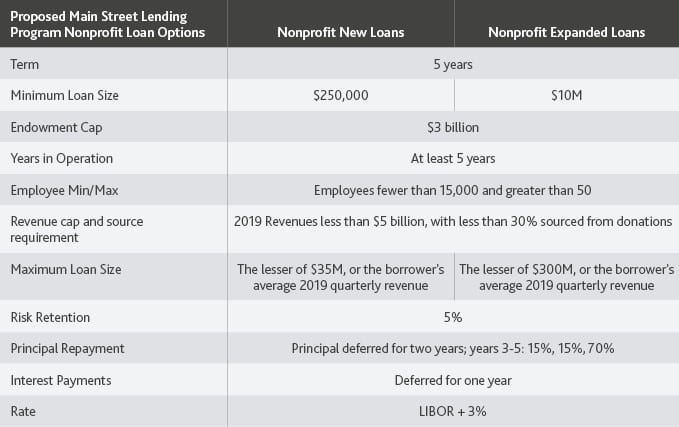

The proposed nonprofit facilities are similar to the three MSLP facilities available to for-profit small and medium-sized businesses. The loan terms such as the interest rate, deferral of principal and interest payments, and a five-year term are the same. Principal payments would be fully deferred for the first two years of the loan, and interest payments would be deferred for one year.

The nonprofit loans would range between $250,000 and $300 million based upon an organization’s operating performance, liquidity and ability to repay debt. Two loan facilities would be offered under the current proposal:

- Organizations entering into loans with new lenders

- Organizations wishing to increase an existing loan or line of credit with an existing lender.

Because a nonprofit does not have some of the financial characteristics of a for-profit to measure its finances, a nonprofit borrower’s eligibility requirements will be modified from the for-profit facilities to reflect the operational and accounting practices of the nonprofit sector. The nonprofit loan program would be available to organizations that have been continuously operating for at least five years with a minimum of 50 and maximum of 15,000 employees. Organizations with endowments exceeding $3 billion would be excluded from participation.

The chart below summarizes key proposed terms.

Source: https://www.federalreserve.gov/newsevents/pressreleases/monetary20200615b.htm.

Detailed descriptions of the draft nonprofit MSLP programs are available via term sheets by the Federal Reserve:

Nonprofit Organization New Loan Facility Term Sheet (PDF)

Nonprofit Organization Expanded Loan Facility Term Sheet (PDF)

Application Process

While the nonprofit Main Street loan application process is not yet open, we expect it will follow the for-profit Main Street loan application whereby the loan is requested at a federally insured lending institution, which will apply its own underwriting criteria. The Federal Reserve is expected to release nonprofit application forms and agreements to be completed in conjunction with a nonprofit loan application that will include borrower certifications and covenants.

BDO Insight

The proposed expansion of the MSLP to nonprofits will provide additional critical liquidity to organizations affected by the current pandemic above and beyond what was provided by the PPP. Organizations should begin forecasting anticipated cashflow needs over an extended period. Effective forecasting will determine how a Main Street loan could help meet those needs.

Nonprofits should also analyze the term sheets for each proposed new Main Street facility and determine the potential facility that is best aligned with their operational strategy and risk profile. In particular, they should consider the loan amount they would qualify for under each facility and whether or not they can (or would be willing to) provide any requisite collateral.

Further, interested organizations need to pay close attention to the required covenants/restrictions to make sure they can stay in compliance. Finally, existing lenders may have to approve the acceptance of additional obligations, so nonprofits should begin speaking with them about this loan option.

It is important to note that the MSLP, including the proposed expansion to nonprofits, is continuously evolving. Monitor the Federal Reserve’s website and visit BDO’s Crisis Response Resource Center for the latest program updates and details.

Article adapted from the Nonprofit Standard blog.