Presentation and Disclosure Examples for FASB ASU on Contributed Nonfinancial Assets

In the Fall 2022 edition of the Nonprofit Standard, Matt Cromwell recently outlined the implementation requirements of Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) 2020-07, Not-for-Profit Entities (Topic 958): Presentation and Disclosures by Not-for-Profit Entities for Contributed Nonfinancial Assets. As noted in the article, the ASU is effective for annual reporting periods beginning after June 15, 2021. This article addresses some common questions encountered during adoption and provides some sample disclosures. These sample disclosures are excerpted from the ASU.

COMMON QUESTIONS

Does the required disclosure of the disaggregation of the amount of contributed nonfinancial assets or gifts-in-kind (GIK) need to be presented by specific categories? The answer to this is no. There is flexibility in the categories that are shown in this disaggregation presentation. The types of categories included in the disclosure should be based on the organization’s specific activities and by the organization’s management applying professional judgment in assessing the needs of the financial statement users. These categories may, in fact, be broad. For example, a food bank organization may choose to have categories of types of food, while a non-food bank entity that receives donations of food may choose to show all food donations in one “food donations” category.

Can I use the term “other GIKs” in my disaggregation note? The answer is yes. The ASU does not preclude an organization from utilizing an other category for smaller items as long as this total does not become significant to the overall aggregation.

SAMPLE DISCLOSURES

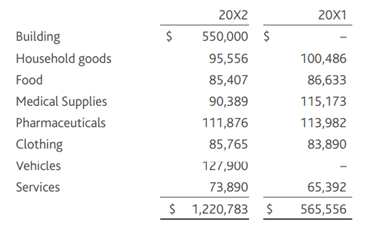

The following is an excerpt from the ASU with a sample disclosure. The table shows the quantitative disaggregation which are then discussed in the descriptions that follow.

SAMPLE NARRATIVE DISCLOSURE:

Contributed Nonfinancial Assets For the years ended June 30, contributed nonfinancial assets recognized within the statements of activities included: (See Note 1 below)

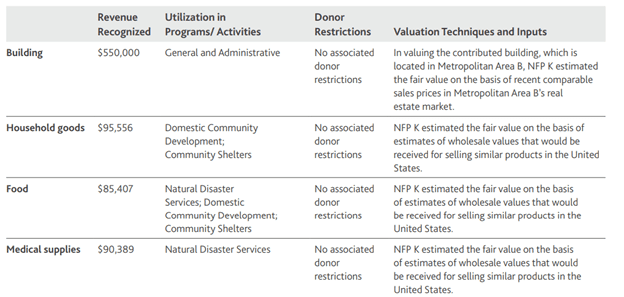

NFP K recognized contributed nonfinancial assets within revenue, including a contributed building, vehicles, household goods, food, medical supplies, pharmaceuticals, clothing and services. Unless otherwise noted, contributed nonfinancial assets did not have donor-imposed restrictions. (See Note 2 below)

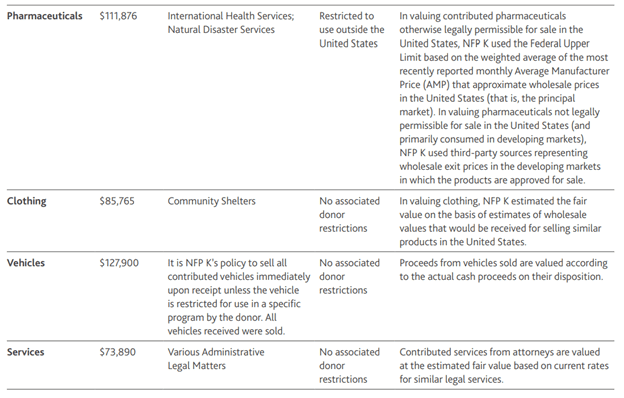

It is NFP K’s policy to sell all contributed vehicles immediately upon receipt at auction or for salvage unless the vehicle is restricted for use in a specific program by the donor. No vehicles received during the period were restricted for use. All vehicles were sold and valued according to the actual cash proceeds on their disposition. (See Note 3 below)

The contributed building will be used for general and administrative activities. In valuing the contributed building, which is located in Metropolitan Area B, NFP K estimated the fair value on the basis of recent comparable sales prices in Metropolitan Area B’s real estate market. (See Note 4 below)

Contributed food was utilized in the following programs: natural disaster services, domestic community development and services to community shelters. Contributed household goods were used in domestic community development and services to community shelters. Contributed clothing was used in specific community shelters. Contributed medical supplies were utilized in natural disaster services. In valuing household goods, food, clothing and medical supplies, NFP K estimated the fair value on the basis of estimates of wholesale values that would be received for selling similar products in the United States. (See Note 4 below)

Contributed pharmaceuticals were restricted by donors to use outside the United States and were utilized in international health services and natural disaster services. In valuing contributed pharmaceuticals otherwise legally permissible for sale in the United States, NFP K used the Federal Upper Limit based on the weighted average of the most recently reported monthly Average Manufacturer Prices that approximate wholesale prices in the United States (that is, the principal market). In valuing pharmaceuticals not legally permissible for sale in the United States (and primarily consumed in developing markets), NFP K used third-party sources representing wholesale exit prices in the developing markets in which the products are approved for sale (that is, the principal markets). (See Note 4 below)

Contributed services recognized comprise professional services from attorneys advising NFP K on various administrative legal matters. Contributed services are valued and are reported at the estimated fair value in the financial statements based on current rates for similar legal services. (See Note 4 below)

ANALYSIS OF DISCLOSURE EXAMPLE

Note 1: The table shows the disaggregation of each category of nonfinancial assets that is deemed to be specific to this entity and information that the readers of the financial statements will find useful.

Note 2: Provides detail of where these contributed nonfinancial assets were recorded in the statement of activities and notes whether there were any restrictions on the contributed assets.

Note 3: This paragraph meets the requirement to disclose whether the entity liquidates any donated nonfinancial assets instead of utilizing them. Here they are disclosing that they liquidate donated vehicles.

Note 4: This paragraph is addressing how each category of contributed items was utilized by the entity and the valuation technique used for determining fair value for each type of contributed nonfinancial asset.

As noted in the Fall article, the information in the above footnote could be provided in table format for ease of reading. See the excerpt from the ASU in a table format on the next page. This is the same information presented above in the narrative format. Organizations should consider what would work best for their entity and the users of their financial statements.

SAMPLE NARRATIVE FORMAT OF DISCLOSURE:

Written by Tammy Ricciardella. Copyright © 2022 BDO USA, LLP. All rights reserved. www.bdo.com