Are Grants Subject To Revenue Recognition?

By Lee Klumpp, CPA, CGMA

The FASB clarifies longstanding question for nonprofits.

Nonprofits received long-awaited clarification on a key accounting question from the Financial Accounting Standards Board. As discussed in the article on page 1, the FASB released a final accounting standards update (ASU), Not-for-Profit Entities (Topic 958): Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made. The ASU aims to standardize how grants and other contracts are classified across the sector, as either an exchange transaction or a contribution.

Classifying grants as either a contribution or exchange transaction is the first step in implementing revenue recognition. The clarified guidance in ASU 2018-08 aims to help nonprofits complete that first step in a consistent way across the sector.

This article outlines a practical example of the process to evaluate a grant under the new ASU.

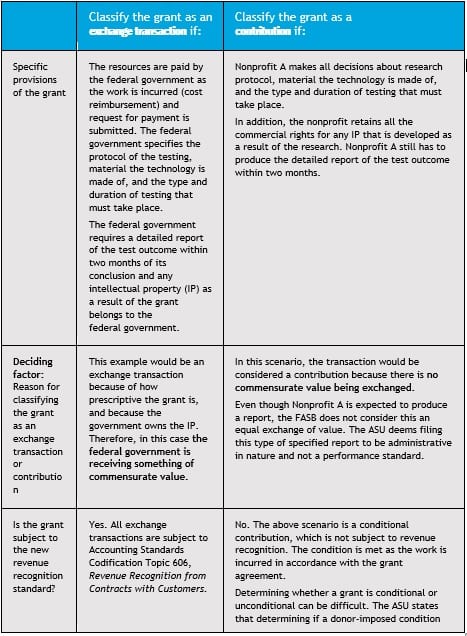

Practical Example: How to evaluate a grant under the new guidance

Description of ‘Nonprofit A’: A large research association that specializes in space exploration. Its mission is advancing scientific discoveries and supporting the advancement of new technology. The organization receives funding from various individuals, corporations and governments to support its efforts.

Description of the grant: Nonprofit A received a $15 million grant from the federal government to finance the costs of a research initiative to test the effectiveness of newly developed technology.

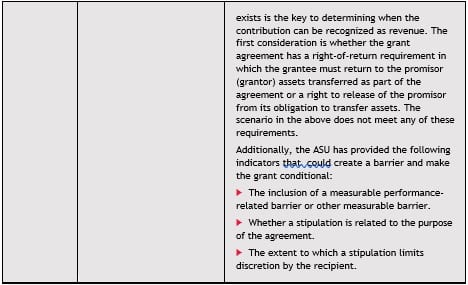

How should Nonprofit A classify the $15 million grant? This grant could be classified as either an exchange transaction or a contribution, depending on the exact parameters of the funding. Let’s examine both scenarios:

Disclaimer: These examples are for illustrative purposes only. Changing even one fact in the example could significantly change the accounting treatment.

What types of organizations need to take action?

- Grantees: All nonprofits that receive grants from foundations, governments or other funding entities will need to assess how they are accounting for contributions. Colleges, universities, research institutions and social services organizations that rely heavily on grants and contracts could see the greatest impact.

- Grantors: Non-governmental organizations like public and private foundations, as well as for-profit entities that issue grants to nonprofits, will need to think about how they write their grants and contracts.

What organizations will not experience a significant impact?

- Public charities: As organizations that derive the bulk of their funding from individual contributions, they will be less impacted by this guidance.

- Local, state and federal governments: Nonprofits will still need to assess how they classify federal and state funding, but governmental bodies are not within the FASB’s scope and do not need to comply with this guidance. Governments are subject to standards issued by the Governmental Accounting Standards Board.

What’s next for nonprofits?

Accounting changes are like a relay race. Today, the FASB handed off clarified guidance on accounting for contributions and answered a long-standing question for the sector. And now it’s up to nonprofits to apply it to their own books and run the rest of the race to implement revenue recognition and finish strong.